56+ what percentage of monthly income should go to mortgage

Ad Apply Online Today For A Diverse Mortgage Solution To Navigate Your Home-Buying Process. Web What Percentage Of Your Monthly Income Should Go To Mortgage A general rule of thumb for homebuyers is your home loan should eat up no more than.

Financial Report 2017 By African Development Bank Issuu

When determining what percentage of.

. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. On a 400000 property a 20. Learn About Our Fixed-Rate Mortgage Adjustable-Rate Mortgage Jumbo Mortgage Options.

Want to Know How to Choose a Mortgage Lender. Apply Get Pre-Qualified in 3 Minutes. Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Web As a general rule of thumb your monthly housing payment should not exceed 28 percent of your income before taxes. Web The 28 Percent Rule. Web The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt.

Find A Lender That Offers Great Service. Web According to this rule a maximum of 28 of ones gross monthly income should be spent on housing expenses and no more than 36 on total debt service. John in the above example makes.

A general rule of thumb for homebuyers is your home loan should eat up no more than 28 of your pre. Ad Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online. Web Ideally home buyers should put at least 20 percent down on their new dwelling but thats simply not possible for many buyers.

Web The 3545 model says that your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income. Ad Compare Mortgage Options Calculate Payments. Save Real Money Today.

This rule says that you should not spend more than 28 of. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. Web What percentage of your monthly income should go to mortgage.

Get Your Estimate Today. Web One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule. Ad Compare Mortgage Options Calculate Payments.

Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including property. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford. Web As the name suggests this rule states that no more than 28 percent of your gross income should go toward your monthly mortgage payment.

Compare More Than Just Rates. Get The Service You Deserve With The Mortgage Lender You Trust. Web The 2836 rule stipulates that in order for a home to be considered within your budget your housing expenses such as mortgage payments taxes and insurance.

Get The Service You Deserve With The Mortgage Lender You Trust. Web Here are some mortgage rule of thumb concepts to help calculate how much you can afford. Web The 36 should include your monthly mortgage payment.

Compare Best Lenders Apply Easily. Apply Now With Quicken Loans. So if your gross.

The 28 rule The 28 mortgage rule states that you should spend 28 or less. In general lenders follow the 28 percent rule meaning no more than 28 percent of your gross income should go to your mortgage. With that your other monthly debt should fit in under the overarching cap of 36.

Apply Now With Quicken Loans. Get Your Estimate Today. Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income.

And you should make. Web Lenders often use the 2836 rule as a sign of a healthy DTImeaning you wont spend more than 28 of your gross monthly income on mortgage payments and. Ad Todays Best Mortgage Lenders By Rates Service.

Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the.

Fee Based Communities In The American Housing Survey Ahs Download Table

How Much Of My Income Should Go Towards A Mortgage Payment

How Much Home Can You Afford Advanced Topics

What Percent Of Income Should Go To My Mortgage

How Much House Can You Afford Readynest

Why Is 58 Of Thailand S Wealth Shared By Only 1 Of The Population Quora

Solved First Filling The Blank A Back End B Front End Chegg Com

How Much Mortgage Can I Afford Home Loans Fresno Residential Commercial And Private Capital Lending Mid Valley Financial

Why Is 58 Of Thailand S Wealth Shared By Only 1 Of The Population Quora

Here S The Budget Of A Couple Who Earns 150 000 And Tithes

How Much Of My Income Should Go Towards A Mortgage Payment

What Percentage Of Income Should Go To Mortgage Banks Com

Do Recommended Budget Percentages Mean Anything

Std Ar Corp Gov Standard Bank Investor Relations

Calameo 3645754 Content

What Percentage Of Your Income To Spend On A Mortgage

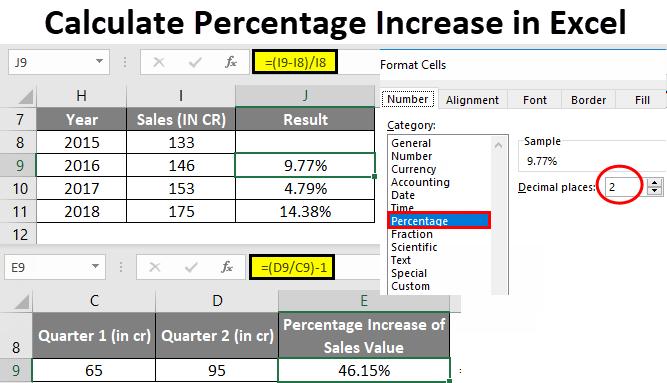

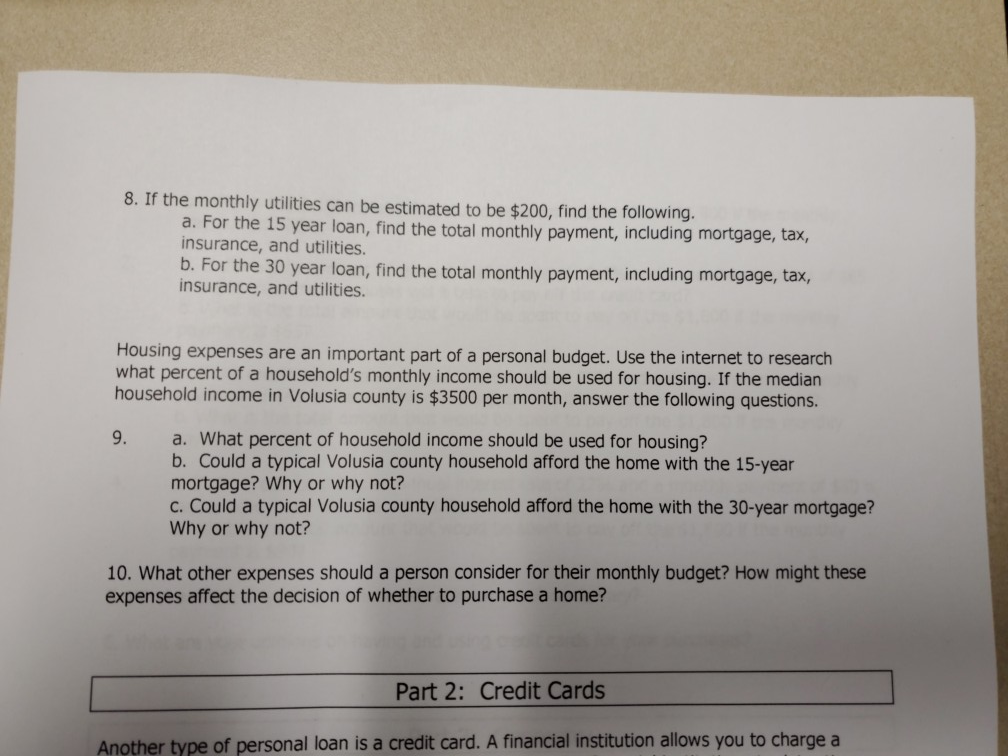

Solved Part 1 Mortgage A Mortgage Is A Loan Used To Chegg Com